Your employer must give you a pay stub every time they pay you. Your pay stub may seem hard to read. But the information is important.

Do you see red words on this page? Click or tap these words to learn what they mean. Or visit the Easy Reading Dictionary.

Your pay stub shows many things, such as:

- Your earnings. This is another word for your pay.

- The number of hours you worked.

- Your income tax deductions.

You should check the information carefully to make sure it is right.

Example

Let’s look at Jim's job to help you understand your pay stub.

Jim works at a gas station. He makes $16 per hour.

Jim gets paid every 2 weeks. This is called his pay period.

When his pay period is over, Jim gets a cheque from his employer. He gets a pay stub with his cheque.

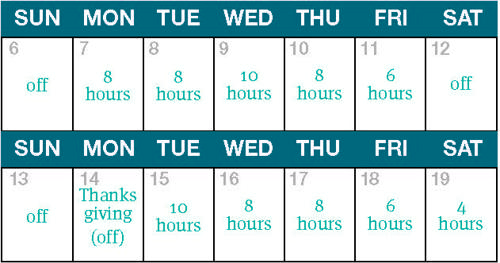

Here is Jim’s work schedule for 2 weeks. It shows how many hours he worked.

Here are the things Jim sees on his pay stub.

Earnings

This is what Jim earned, which is another word for Jim’s pay. It includes his:

- Regular hours

- Overtime

- Time off with pay

- Vacation pay

- General holiday pay

Gross pay

This is all the money added up under “earnings” on Jim’s pay stub. It is the money he earned before deductions were taken away. Here are the things Jim sees listed as gross pay:

- Overtime. The law says you can work up to 8 hours a day or up to 44 hours a week for regular pay. For most types of work, if you work longer, it is called overtime.

Some workers get paid more to work overtime hours. Their overtime pay will be at least 1.5 times their regular pay for those hours. Other workers get time off with pay instead of overtime pay. - Time off with pay. Sometimes, workers who work overtime hours can choose to take paid time off work instead of being paid more. For example, if you work 5 hours of overtime, you can work at least 5 hours less another day. But you must tell your employer first.

- Vacation pay. All workers earn vacation pay. It is a percentage of your regular pay. You can get vacation pay with each paycheque. Or you can get it when you go on vacation.

- General holiday pay. Alberta has 9 general holidays. Some workers get paid more to work on a holiday. Some workers get paid even if they do not work on a holiday.

Deductions

These are the amounts of money taken away from each of Jim’s paycheques. Here are the deductions Jim will see on his pay stub:

- Income tax. You pay income tax with each paycheque. It is a percentage of what you earn. Income tax pays for things like roads and police.

- Employment insurance (EI). You pay this with each paycheque. It is a percentage of your earnings. If you lose your job and it is not your fault, you can apply to get EI. You can also get EI for other reasons. For example, when you have a baby.

- Canada pension plan (CPP). You pay this with each paycheque. It is a percentage of your earnings. The Canada pension plan will help support you when you are older and retire (stop working). When you retire, you will get some money each month.

- Pension. Your employer might have a private pension plan that is separate from the Canada pension plan. A private pension pays you money when you are older and retire. You still get your Canada pension when you get your private pension. A little bit of pay is taken from every paycheque for your private pension. It is your choice whether you want to pay into the company’s private pension plan.

- Benefits. These are programs an employer chooses to offer to its workers. For example, if you have dental benefits, your benefit plan will help you pay for your dental bills. You do not have to take the benefits your employer offers. If you do choose to take benefits, then you pay a deduction with each paycheque.

- Union dues. Some workers belong to a union. If you are in a union, you must pay dues (money). You pay these dues as a deduction on every paycheque.

Net pay

This is how much you earn after you pay your deductions. Your net pay is the pay you get to keep.

Year to date, or YTD

YTD is how much of something on your pay stub has happened so far this year. For example, the amount of pay or deductions.

Take a close look at your own pay stub

Read your pay stub with care. Make sure you are paid the right amount. Talk to your employer if you have questions.

- Is it clear to you how your employer calculated your net pay? This is an important thing to be sure of. Your net pay shows how much money you get to keep.

- Are the deductions on your pay stub easy to understand?

- Are the calculations correct?

To make sure you are being paid correctly:

- Always write down the number of hours you worked.

- Keep track of your regular hours.

- Keep track of your overtime hours.

- Write your hours on a calendar, like the example we showed you of Jim’s pay period. Or put them in your smartphone.

Keep your pay stub in a safe place

Employers may pay your wages in cash, by paper cheque, or by direct deposit online. But employers must always have a pay stub for you. They must let you see and print your pay stubs.

Keep your pay stubs for a few years. You may need them. For example, your employer might go out of business and owe you money. If this happens, you can complain to Employment Standards. They will need your pay stubs to help you get your money.

Always take care to look at your pay stub. It has a lot of important information. If you check your pay stub, you can make sure everything on it is correct.