Employers must take some money out of your paycheque and send it to other places. The amounts of money they take are called deductions.

Do you see red words on this page? Click or tap these words to learn what they mean. Or visit the Easy Reading Dictionary.

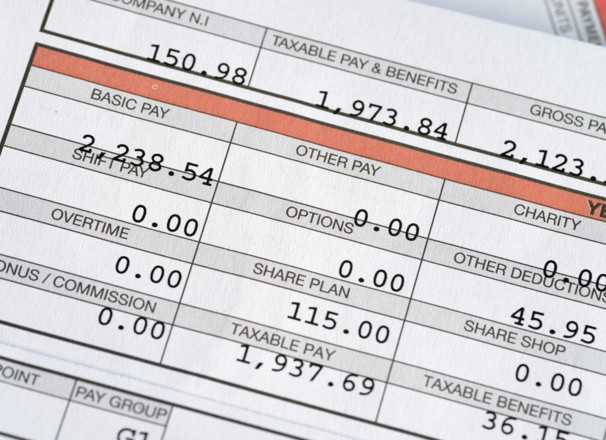

Here are the types of deductions that may come out of your pay.

Government deductions

The government gets some of your deductions. It pays for things people use. For example, roads, police, doctors, and pensions. You can have many different government deductions:

- You can have a deduction for income tax.

- You can have a deduction for employment insurance (EI).

- You can have a deduction for the Canada pension plan (CPP).

Money that you owe

Money may also be taken from your paycheque because a judge says you owe money. The court sends a letter to your employer to deduct the money:

- If you owe taxes from other years

- If you do not pay the child support you owe

- If someone sued you and you lost, and you didn’t pay the money you owed

Benefits, dues, and plans

Money will be taken from your pay if you belong to a union. This deduction is called union dues.

Money may be taken from your paycheque if you want benefits that your union or employer offers. A benefit may sometimes be called a plan.

Your employer may offer these benefits:

- Medical or dental benefits

- A private savings plan or pension plan

- A life insurance plan

There are many kinds of benefits and plans. Your employer decides whether to offer any. If more than 1 benefit is offered, it is called a benefit package.

You will pay deductions so you can use those benefits. Your employer might also help pay for some of the cost of a benefit.

You and your employer must agree to these amounts. Then you must sign a paper to say it is OK for your employer to take money from your pay.

Other deductions

Employers can also deduct money for other things. These are things that cost your employer money. For example, your employer may give you meals and a room to stay in.

You must agree that you owe money to your employer for these costs. You must sign a paper to say you agree. Often, you sign this paper when you start the job.

To learn more, visit Deductions for meals and lodging.

Deductions your employer cannot make

There are certain deductions that your employer is not allowed to make.

Uniforms

Employers cannot deduct money for clothes you wear for work (uniforms). You do not have to pay for uniforms.

Example

Bashir started work at Mary’s restaurant this week. He makes $16 an hour.

Mary gave Bashir a T-shirt to wear as a uniform when Bashir started. Bashir does not have to pay for this.

On 2 of the days he worked, Bashir did not pack a lunch. He ordered food from the restaurant’s menu instead. Each lunch cost $4. Bashir wrote the cost each day on his time sheet. He signed his name to show he agreed to the deduction. Mary will deduct the cost of his lunches from his paycheque.

Mistakes at work

Your employer cannot deduct money for mistakes or accidents. You do not need to pay for a mistake.

Examples

Ahmed made a mistake at work. He broke a tool. His employer told him to be more careful. Ahmed cannot be made to pay for a new tool.

Priya works as a server in a restaurant. One day, a customer left but did not pay for the food. Priya’s employer cannot take the cost of the food from her pay.

Grace is a cashier. Her co-workers sometimes use Grace’s cash register. Grace has to count her cash at the end of the day. On some days, her total is less than it should be. This difference is called a shortage. Grace’s employer cannot take the shortage from Grace’s pay.

It may seem like your paycheque has a lot of deductions. Remember that these deductions help pay for things that will help you in life. Check your pay stub to make sure your employer is not making deductions they are not allowed to make. To learn more, visit Deductions from earnings.